Investor Relations

Home > Corporate Governance Overview Statement

Corporate Governance Overview Statement

The Board of Directors (the “Board”) of Oriental Holdings Berhad (“OHB” or the “Company”) remains committed to implementing and maintaining high standards of corporate governance practices that are premised on the notions of transparency, accountability and integrity with a view to enhance stakeholders’ value. In the adoption of corporate governance best practices, the Board focuses on the substance of corporate governance principles, beyond the mere form.

This Corporate Governance Overview Statement (“Statement”) is prepared pursuant to Paragraph 15.25(1), including Practice Note 9, of the Main Market Listing Requirements (“Listing Requirements”) of Bursa Malaysia Securities Berhad (“Bursa Malaysia”), and has considered practices of the Corporate Governance Guide (4th Edition) of Bursa Malaysia.

This Statement provides an articulation of OHB’s application of the Principles of the Malaysian Code on Corporate Governance (as at 28 April 2021) (“MCCG”) for the financial year ended 31 December 2024.

This Statement is supplemented with OHB’s Corporate Governance Report for FY2024, which discusses how the Practices of MCCG are applied in OHB. The Corporate Governance Report is available on OHB’s website and via an announcement on Bursa Malaysia’s website.

This Statement should also be read in conjunction with the other statements in the Annual Report, e.g. Statement on Risk Management and Internal Control, Audit Committee Report, and Sustainability Statement.

CORPORATE GOVERNANCE APPROACH

The Board of OHB is focused on ensuring the Company and its subsidiaries (collectively referred to as the “Group”) continue to strive forward with the vigour and tenacity that has consistently produced value to its stockholders as well as the wider stakeholders. The Board believes that a robust and dynamic corporate governance framework is essential to providing a solid foundation for effective and responsible decision-making in OHB.

OHB’s key approach to a robust and dynamic corporate governance framework is to:

- have the appropriate people, processes and structures to direct and manage the business and affairs of the Group;

- promote the long-term sustainability of the Company by identifying business opportunities whilst equally being cognisant of the associated risks; and

- drive the application of good corporate governance practices through the alignment of the interests of stakeholders and Board as well as Management.

In its effort to promote meaningful and thoughtful application of good governance practices, the Board regularly reviews the Company’s corporate governance policies and procedures to ensure they reflect the latest curation of thoughts, market dynamics and best practices whilst simultaneously addressing the needs of the Group.

SUMMARY OF CORPORATE GOVERNANCE PRACTICES

OHB has applied all of the Practices encapsulated in the MCCG for the financial year ended 31 December 2024, save for:

- Practice 5.2 (having majority Independent Non-Executive Directors on the Board);

- Practice 5.3 (seeking annual stockholders’ approval through a two-tier voting process to retain an Independent Non- Executive Director beyond nine (9) years);

- Practice 5.9 (having at least 30% women directors);

- Practice 8.2 (disclose top five senior management’s remuneration component); and

- Practice 12.2 (the adoption of Integrated Reporting).

In relation to the aforementioned departed Practices, the Company provided explanations for their non-application, augmented with an articulation of alternative practices adopted which have considered the Intended Outcomes envisioned by the said Practices. Details of the application of the Practices are disclosed in OHB’s Corporate Governance Report.

OHB’s corporate governance practices are made with reference to the three (3) Principles of MCCG as outlined below:

PRINCIPLE A: BOARD LEADERSHIP AND EFFECTIVENESS

I: Board responsibilities

The Board is primarily responsible for directing and providing leadership for the overall strategic direction of the Group, focusing on value creation, balancing the interest of various stakeholders and across the short and long terms. In the pursuit of long-term value creation and formulation of long-term strategy for the Company, the Board incorporates economic, environmental, and social considerations, in line with its commitment to driving sustainable development and exercising corporate social responsibilities.

The Board is guided by an established Board Charter which stipulates the roles and responsibilities of the Board, Board Committees, and individual Directors, matters reserved for the Board’s decision, as well as processes and practices which the Board and Directors are required to adhere to. All Directors are further required to observe the Directors’ Code of Ethics which aligns the duties of a Director with good corporate governance practices, including addressing conflict of interest.

The Board sets the tone for how the Company’s business and affairs should be managed, through various key policies and principles such as the Sustainability Policy which guides the Group’s direction in managing environmental, social, and governance matters, the Anti-Bribery and Corruption Policy that specifies the Group’s stance against corruption, and the Code of Ethics which stipulates the ethical standards expected of all Directors and employees of the OHB Group.

The summary of the Group’s Board Charter and key governance policies are published on OHB’s website at www.ohb.com.my.

Board Committees

The Board is assisted by various Board Committees, namely the Executive Committee (“EXCO”), Audit Committee (“AC”), Nominating Committee (“NC”), Remuneration Committee (“RC”), and Risk Management Committee (“RMC”), with respect to specific oversight matters. The Board delegates authority to the Board Committees through respective Terms of Reference (“TOR”) but maintains ultimate responsibility.

The summary of the Group’s Terms of References for the AC, NC, and RC are published on OHB’s website at www.ohb.com.my.

Summary of Board Committees

The EXCO is comprised of the four (4) Executive Directors and is responsible for overseeing the implementation of Board decisions and policies at the Management level.

During the financial year under review, the EXCO approved the Group’s annual budget as well as the budget for all segments. The annual budget was subsequently summarised and tabled to the Board for its endorsement. The EXCO monitors segment performance via quarterly reports by each segment’s Performance Coordinating Teams (“PCT”) and reports to the Board. The EXCO also carries out the roles of a Sustainability Committee ( “SC”) of the Group.

The AC is comprised exclusively of Independent Non-Executive Directors. The AC assists and supports the Board in reviewing the process for the preparation of the Group’s financial reports including significant financial reporting issues and judgements, the integrity of internal control system, and the external and internal audit processes and outcomes.

The NC is comprised exclusively of Independent Non-Executive Directors. The NC reviews the composition and effectiveness of the Board, ensuring the quality of Directors and overseeing the process for the nomination, assessment, and selection of Directors. Activities of the NC include recommending to the Board any candidature for Directors, overseeing the assessment of the Board, Board Committees, and individual Directors, facilitating Directors’ induction, reviewing Directors’ training, and reviewing the Board’s succession plans.

The RC is comprised exclusively of Independent Non-Executive Directors. The RC is primarily responsible for reviewing and recommending to the Board the remuneration of Executive Directors in accordance with the Director Remuneration Policy.

The RMC is tasked to review the Group’s risk management system, processes, and strategies.

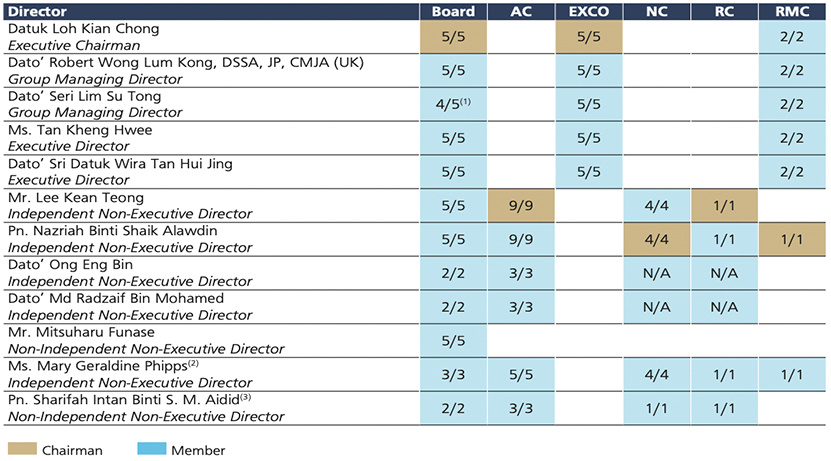

Meetings of the Board and Board Committees

The Board and Board Committees meet regularly to carry out their responsibilities. Details of the meetings and Directors’ attendances are summarised below:

(1) As at the date of this Statement, Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK) ceased to be a member of EXCO and RMSC, following his redesignation as Non-Independent Non-Executive Director on 13 November 2024.

(2) Ms. Tan Kheng Hwee was absent for the RMSC Meeting held on 20 August 2024 due to unavoidable clash in scheduling.

(3) Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK) was absent for the Board and EXCO Meeting held on 11 November 2024 due to a prior urgent appointment that could not be rescheduled.

During the year, all Directors have devoted adequate time to prepare, attend, and actively participate in the Board and Board Committee meetings. To ensure Directors have sufficient time to review and prepare for meetings, materials and papers for Board and Board Committee meetings are circulated at least seven (7) calendar days prior to the meeting. The meeting minutes are prepared to reflect the decisions made, including key deliberations, rationale supporting the resolution, and any significant concerns or dissenting views voiced out by Directors. The minutes also indicate whether any Director abstained from deliberating and voting on specific matters, including for reasons due to conflict of interests. The meeting minutes are circulated to the Board and Board Committees for confirmation subsequent to the meeting to ensure the completeness and accuracy of the minutes.

Access to Senior Management, information, Company Secretaries, and professional advice

All Directors have the right of access to information and to Senior Management in furtherance of their duties and responsibilities as member of the Board or Board Committees. The Board also has unrestricted access to the services of two (2) competent and suitably qualified Company Secretaries who fulfil the requirements set out in Section 235(2) of the Companies Act 2016. The Company Secretaries regularly apprise the Board on the latest regulatory developments on corporate governance and assist the Board in interpreting and applying pertinent corporate governance practices. Where necessary, the Board, Board Committees, and Directors are also entitled to independent professional advice relating to their responsibilities.

II: Board composition

Board quality and diversity

The Board has an appropriate mix of skills, qualifications, attributes, and experience across relevant industries as well as in the fields of audit and accounting, tax, and law. The combined skills and expertise of the Directors provide a breadth and depth of perspectives and diverse insights that can refine the decision-making process of the Board in pertinent areas.

The composition of OHB’s Board takes into consideration the Board Diversity Policy which promotes diversity in various aspects including skills, experience, age, cultural background, and gender and does not discriminate on the bases of race, age, ethnicity, gender, nationality, political affiliation, religious affiliation, sexual orientation, marital status, education physical ability, or geographic region.

The Board Diversity Policy is central to:

- identifying and creating the right balance of skills and industry experience, background and gender of Directors;

- retaining Directors based on performance and merit, in the context of skills, time commitment and experience, in order for the Board to be effective;

- providing a safe and healthy environment for the views of Board members to be heard, their concerns attended to, and where bias, discrimination and harassment on any matter are not tolerated; and

- reviewing and assessing the Board and Key Senior Management’s composition and mix and make recommendations on the appointment of new Directors and Key Senior Management.

As at the date of this Statement, the composition of our Board comprises 2 women Directors out of 10 Directors, i.e. 20%. Nevertheless, the Board is mindful that any gender representation should be in the best interest of the Company. Our Board has established a Board Diversity Policy to guide the composition of the Board. The NC and the Board will continue to leverage various channels, including independent recruitment firms, directors’ registries and professional body memberships to identify a wider spectrum of suitable and talented individuals for directorships, including female candidates.

In carrying out its responsibilities, the Board, through the NC, considers whether Directors and Key Senior Management, including candidates for Directors and Key Senior Management, possess the qualities required by the Group, including but not limited to, their character, experience, competence, integrity, and their commitment of time and efforts to the Group.

In alignment with the introduction of the requirement for listed issuers of Bursa Malaysia to have a fit and proper policy for the appointment and re-election of directors of the listed issuer and its subsidiaries, the Board has established a Fit and Proper Policy for the OHB Group, which is applicable to all directors of OHB and its subsidiaries. The Fit and Proper Policy sets out 6 fit and proper criteria which a director of the OHB Group shall satisfy, and the NC is entrusted to apply the Fit and Proper Policy in the nomination and review of OHB Directors.

The summary of the Group’s Fit and Proper Policy is published on OHB’s website at www.ohb.com.my.

Checks and Balances

The Board is chaired by Datuk Loh Kian Chong while Dato’ Seri Lim Su Tong serve as Group Managing Director, and Dato’ Sri Datuk Wira Tan Hui Jing as Deputy Group Managing Director. The positions of the Chairman of the Board and the Group Managing Director of OHB are held by different individual to facilitate a clear division of responsibilities between these positions, enabling effective Board oversight over the Company’s business management and affairs. The Board Chairman’s main roles include facilitating and leading the processes and functions of the Board while the joint Group Managing Directors focus on the business and day-to-day management of the Company.

Each of the Executive Director is in charge of different business segments with their diverse skill sets and experiences. They are accountable to the Board for the achievement of the Group’s goals and objectives, as well as the observance of Management’s authority limits.

The presence of Non-Executive Directors, including Independent Non-Executive Directors, brings objectivity to the Board oversight and decision-making process, enabling it to constructively challenge and probe Management’s proposal for strategies as well as management performance, at the same time bringing diverse perspectives and insights to the Board. The Non-Executive Directors provide check and balance within the Group’s governance structure. In addition, they serve as conduits between stakeholders and Management by taking into account feedback received from stakeholders during Board discussions.

The Board has formalised a policy that sets a 9-year cumulative (consecutive or intermittent) tenure for Independent Non- Executive Directors. If the Board intends to retain a Director as Independent Non-Executive Director after their 9-year tenure, the Board shall justify the decision and seek stockholders’ approval at a general meeting annually. The Board’s consideration for its recommendation includes an independence assessment on the said Director facilitated by the NC.

Independent Non-Executive Director's 12 year limit

Mr. Lee Kean Teong, appointed to the Board on 31 March 2015, has served as a Board member beyond 9 years by FY2025. The NC had, with Mr. Lee abstaining from deliberation and decision-making, reviewed his fit and proper assessment and recommended to the Board to retain him as Independent Non-Executive Director. The Board concurred with the NC's recommendation and recommended with justifications, for stockholders' approval in the forthcoming AGM on 10 June 2025 to retain Mr. Lee as an independent Non-Executive Director beyond the 9-year tenure and below the 12-year limit as stipulated in the Listing Requirements. The NC had, with Mr. Lee abstaining from deliberation and decision-making, recommended the continuation in the office of Mr. Lee, an INED of the Company, subject to the approval from the stockholders at the forthcoming AGM on 10 June 2025.

Annual Board Assessment

Annually, the Board, Board Committees, and individual Directors are subjected to a comprehensive assessment on their performance and effectiveness (“Board Assessment”) during the year. The process is overseen by the NC and is administered via questionnaire to facilitate both self and/ or peer evaluation for the Board, each Board Committee (including the AC), each Director, the independence of each Independent Non-Executive Director.

Amongst others, the topics or criteria reviewed in the Board Assessment include, but not limited to, the following:

- Board composition;

- Board meetings;

- Board processes;

- whether the Board carries out its responsibilities;

- the Company’s strategic direction and overall performance including how sustainability is addressed or managed;

- individual Director’s character, contribution, performance, and participation and commitment; and independence.

OHB engages an independent, external consultant to facilitate the Board Assessment, including compilation, analysis, and reporting the evaluation results, to enhance the rigour and objectivity of the Board Assessment. Directors’ feedback and comments are discussed with the NC Chairman and the Board on the basis of anonymity to encourage honest assessment and feedback by Directors.

Based on the annual Board Assessment carried out for the financial year under review, at the recommendation of the NC, the Board is satisfied with the overall Board composition which brings diverse perspectives and insights as well as checks and balances, the effectiveness of the Board, Board Committees, and individual Directors, and that the Board has carried out its duties objectively in the best interest of the Company.

The Board Assessment process and the assessment forms used to identify improvement areas to enhance the effectiveness and efficiency of the process and quality of the assessment was last reviewed by the Board, through the review of the NC in FY2024.

Nomination and Selection of Directors

The NC undertakes the responsibility for sourcing for suitable candidates for directorships and making recommendations to the Board pertaining to the appointment, re-appointment, election, or re-election of Directors. The NC makes its recommendations via established processes backed by relevant supporting elements such as fit and proper assessments and assessments of the director or candidate in question, including considerations of their character, experience, integrity, competence, and whether they can commit time to the Group.

The NC and the Board reviewed the Directors who are retiring at the forthcoming AGM and subject to re-election pursuant to Clause 103 and Clause 110 of the Company’s Constitution respectively:

Retire by rotation pursuant to Clause 103 of the Company’s Constitution

- Datuk Loh Kian Chong;

- Puan Nazriah Binti Shaik Alawdin; and

- Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK).

Retire pursuant to Clause 110 of the Company’s Constitution

- Mr. Kunitomo Asano (Appointed on 1 April 2025)

The NC has reviewed the fit and proper assessment of Datuk Loh Kian Chong, Puan Nazriah Binti Shaik Alawdin, along with Mr. Kunitomo Asano and is of the view that these Directors satisfy the Board’s requirements and expectation with respect to their performance. The Board concurred with the NC’s recommendation and recommended the abovementioned Directors to stockholders for their re-appointment and/or re-election. The rationale and reasons for recommending the re-election of each Directors are detailed in the Notice of the forthcoming AGM.

Meanwhile, the NC and the Board (excluding Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK)) have reviewed the fit and proper status of Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK), who is retiring pursuant to Clause 103 of the Company’s Constitution. They have concluded that he does not meet the prescribed criteria for re-election. Consequently, both the NC and the Board (excluding Dato’ Robert Wong Lum Kong, DSSA, JP, CMJA (UK)) do not support his re-election at the forthcoming AGM. This decision underscores the Board’s commitment to maintaining high standards of performance, accountability, and long-term value creation for shareholders. The Board extends its gratitude for his valuable contributions and dedicated service throughout his tenure.

In the sourcing of candidates to act as OHB’s Directors, the NC leverages on various sources including Directors’ network, referrals from Management and/or stockholders, and independent sources such as registry of directors, open advertisements, and independent search firms, to consider a wider pool of candidates.

The Board, through the NC, ensures that the recruitment and selection process for the Directors are appropriately structured so as to ensure a diverse range of candidates are considered and that there are no conscious or unconscious biases against candidates.

The NC utilizes independent sources and recommendations from Directors to identify potential candidates for filling vacancies for Independent Non-Executive Directors ("INEDs") when necessary. This approach is part of the NC’s ongoing practice to ensure a robust and transparent selection process.

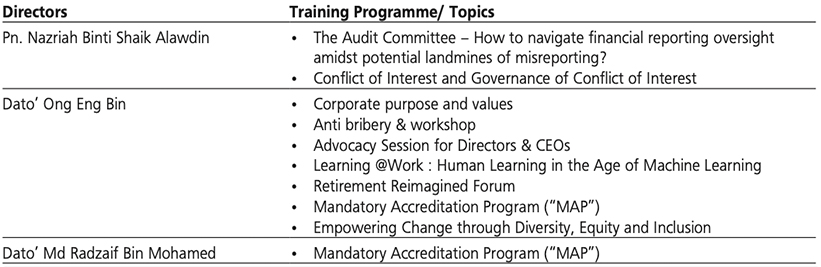

Directors' Training

The Board, through the NC and considering the outcomes of the Board Assessment amongst others, assessed the training needs of the Board and Directors. During the financial year under review, all Directors attended relevant trainings in order to upskill themselves and keep themselves abreast of the latest market developments relevant to the growth and performance of the Group. All Directors attended training on “MAP II: Leading for Impact”.

Additional trainings attended by the Directors during the year are as below:

Summary of activities of the NC for the financial year

The key activities carried out by the NC for the financial year under review are summarised as follows:

- reviewed the processes and criteria of the Board Assessment;

- oversaw the facilitation of Board Assessment;

- reviewed the Board composition, performance of the Board, Board Committees, and individual Directors, including the application of the Fit and Proper Policy as well as the independence of Directors;and

- reviewed and made recommendations on the re-election of Directors

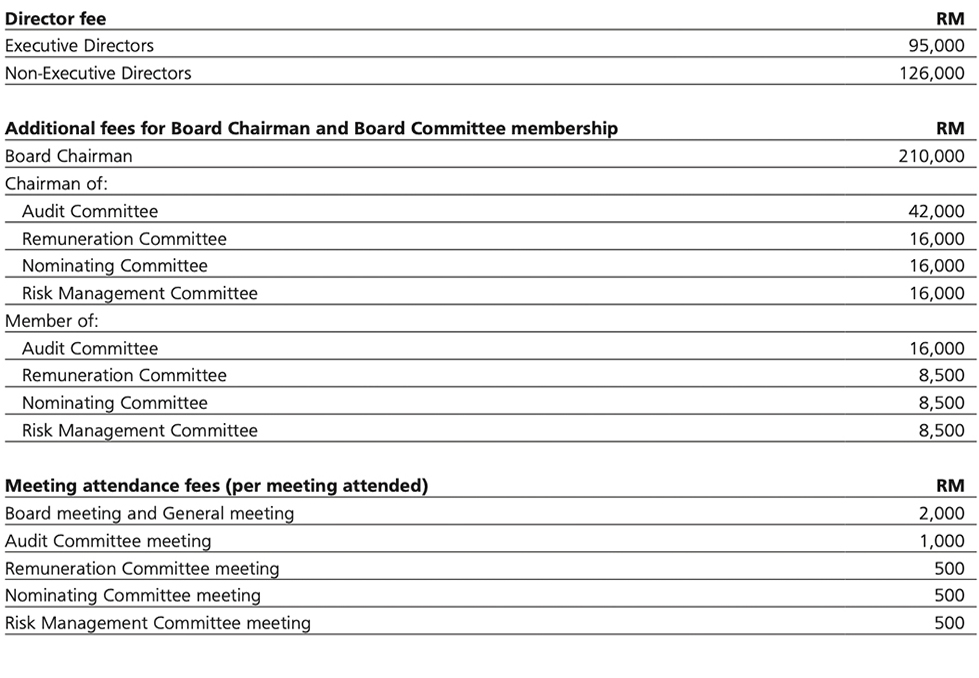

III: Remuneration

The Board has established a Directors’ Remuneration Policy which sets out the principles and guidelines for remuneration practices for the Board and Key Senior Management N1 of OHB. The Directors’ Remuneration Policy is developed to support OHB in attracting and retaining talent in the Board and Key Senior Management to achieve the Company’s long-term objectives.

The remuneration of Executive Directors include components structured to link to the Group and individual performance to incentivise performance, in addition to basic salaries and fringe benefits. The remuneration of Non-Executive Directors comprises fees for their services, reflecting their scope of responsibilities, experience, and contribution to the Board, including positions held at Board Committees. The remuneration of Non-Executive Directors does not include performance based bonuses.

The RC assists the Board in overseeing the review of Executive Directors’ remuneration, as well as the remuneration policies and procedures, guided by the Directors’ Remuneration Policy.

The summary of the Directors’ Remuneration Policy is published on OHB’s website at www.ohb.com.my.

During the financial year under review, the RC has reviewed and made recommendations to the Board on the Executive Directors’ remuneration packages. The Board as a whole also deliberated on the remuneration of Non-Executive Directors. During the deliberation process, the Directors concerned abstained from deliberating and voting on matters pertaining to their individual remuneration.

The Directors’ fees, other fees and allowances proposed by the Board will be tabled for stockholders’ approval during the forthcoming AGM.

Remuneration Package for Executive Directors / Key Senior Management

The remuneration of Executive Directors is structured to ensure the rewards are linked to their performance and contributions to the Group’s growth and profitability in order to align the interest of the Directors with those of stockholders. The Committee also considered the extent of responsibilities undertaken by the individual Executive Director and their respective contribution to the effective functioning of the Board in arriving at their level of remuneration.

N1: The Executive Committee members, by virtue of their positions as Executive Directors of the Group, form part of the Key Senior Management of the Group that is primarily responsible for the business operations of OHB’s core businesses and principal subsidiaries.

Remuneration Package for Non-Executive Directors

As for Non-Executive Directors, their level of remuneration reflects the experience, time commitment and scope of responsibilities undertaken by the said Directors as well as the onerous challenges in discharging their fiduciary duties.

Fees

All Directors are paid meeting fee for each meeting attended. In recognition of the additional time and commitment required, the Directors also received annual fee arising from their participation in Board Committees.

The payment of Directors’ Fees and benefit payable to the Directors is tabled for stockholders’ approval at the AGM.

The various fees for the Directors as approved by the Board on 26 February 2025 is set out as follows:

PRINCIPLE B: EFFECTIVE AUDIT AND RISK MANAGEMENT

I: Audit Committee

The Board has established an AC whose roles include assisting the Board in reviewing the process for the preparation of the Group’s financial reports including significant financial reporting issues and judgements, as well as overseeing the external and internal audit processes of the Group.

The AC is chaired by an Independent Non-Executive Director and is not the Board Chairman. The AC is comprised exclusively of Non-Executive Directors of which majority are Independent Non-Executive Directors, in line with the Listing Requirements, ensuring objectivity of the AC in carrying out its duties. The AC consists of members with relevant skills and experience, including in the fields of accounting, audit, and legal, and the financial literacy required to enable a sound understanding of financial matters of the Company and the Group.

To enhance the independence and objectivity of the AC, it further adopted Practice 9.2 of the MCCG, requiring a former partner of its external audit firm to observe a cooling-off period of at least three (3) years before being appointed as a member of the AC.

The AC has unrestricted access to both the Internal and External Auditors, who in turn report directly to the AC. The AC also provides avenues for the External Auditors to discuss matters with the AC without the presence of Management.

The AC and its members are assessed by the NC, via the Board Assessment process, on an annual basis. For the financial year under review, based on the outcome of the Board Assessment conducted, the Board is satisfied with the AC’s performance and that its Chairman and members are able to understand matters under the purview of the AC including the financial reporting process. All members of the AC attended relevant trainings in order to upskill themselves and keep themselves abreast of the latest market developments relevant to the growth and performance of the Group.

External Auditor's suitability, objectivity, and independence

The AC’s responsibilities include ensuring the suitability of the External Auditor. In this regard, the Board, through the AC’s recommendation, has established policies and procedures to safeguard the quality of External Auditors, including annual assessment of the independence, suitability, and objectivity, as well as the professional fees for the External Auditor.

The AC has formalised policies and procedures for the provision of non-audit services by the External Auditor and their affiliates. Non-audit services are considered against the nature and fees of services, amongst others, to safeguard the objectivity and independence of the roles of the External Auditor.

In FY2024, the AC and Board have streamlined the policies and procedures on non-audit services and non-assurance services to enhance the efficiency.

On an ongoing basis, the AC reviews the non-audit services rendered by the External Auditor and their affiliates at both the Company and Group levels.

During the year under review, the Board has received confirmation from its External Auditor that its personnel are and have been independent throughout the conduct of audit engagement in accordance with the terms of relevant professional and regulatory requirements.

II: Risk Management and Internal Control Framework

The Board of OHB maintains robust and comprehensive risk management and internal control system to safeguard the Company’s assets and to enable the preparation of true and fair view of the financial statements, amongst others. The RMC, a Board Committee, is established and tasked to review the Enterprise Risk Management (“ERM”) Framework, processes, and strategies while the internal control system is reviewed and enhanced on an ongoing basis supported by the risk management processes.

The ERM Framework facilitates the structured identification, evaluation, management, monitoring, and reporting of risks faced by the Group’s business. The risks considered in the ERM process include various risk categories including strategic risks, operational risks, financial risks, sustainability risks, reputational risks, corruption risks, etc. The heads of the Group’s business segments are responsible for managing the identified risks and mitigating risk to acceptable risk levels. The business segments report to OHB and the RMSC periodically. The RMSC ensures priority is placed on the significant risks faced by the Group, setting out rigorous review of the top five (5) business risks, top three (3) climate-related risks, top three (3) climate-related opportunities and top three (3) corruption risks which are measured against Key Risk Indicators (“KRIs”), where relevant, control effectiveness, and progress of Management’s action plans.

Adequacy and effectiveness of internal control system

The Board is ultimately responsible for reviewing the adequacy and integrity of the Group’s risk management and internal control systems. In this regard, the Board is supported by the AC who reviews the Group’s internal control system via the works of the Internal and External Auditors, e.g. the assessment of internal controls over financial reporting and the outcome of internal audit.

The Group has an in-house internal audit function which provides the Board, through the AC, independent assurance on the adequacy and effectiveness of the governance, risk management, and internal control of the Group. Internal audit activities carried out are in line with a globally recognised framework, namely the International Professional Practices Framework (“IPPF”) as promulgated by the Institution of Internal Auditors (“IIA”). The internal audit function and its personnel are independent of the activities they audit, and the Head of Internal Audit has direct access to the AC.

The AC assesses the performance of Internal Audit function on an annual basis to ensure the Internal Auditors have performed effectively and have acted independently in the conduct of internal audit activities. All eleven (11) Internal Audit personnel, including the Head of Internal Audit, are free from any relationships or conflicts of interest which could impair their objectivity and independence.

Further details of the internal audit function are disclosed in the Audit Committee Report.

Assurance from Management

The Board has also received written assurances from Executive Chairman, Executive Directors and Group Chief Financial Officer on the adequacy and effectiveness of the Group’s risk management and internal control system in all material aspects.

The details of the Risk Management and Internal Control Framework are set out in the Statement on Risk Management and Internal Control of this Annual Report.

PRINCIPLE C: INTEGRITY IN CORPORATE REPORTING AND MEANINGFUL RELATIONSHIP WITH STAKEHOLDERS

I: Communication with Stakeholders

In line with its responsibility towards the stewardship of OHB’s business and affairs whilst taking into account stakeholders’ interest, the Board recognises its roles in fostering transparent, active, and constructive communication with its stakeholders.

In this regard, the Board ensures there are channels to engage with stakeholders to obtain sufficient understanding of their interest and needs, as well as to communicate relevant information to stakeholders including relevant sustainability strategies, priorities, targets, and performance. The Group’s key stakeholders, channels and modes through which the Group engages with stakeholders, and key focus areas, and expectations of stakeholders are summarised in OHB’s Sustainability Report.

The Board has formalised a Corporate Disclosure and Communication Policy to govern the dissemination of information to stakeholders. Amongst others, the policy covers the procedures on publications of reports, conduct of events such as analyst and investors’ engagement sessions, procedures on responding to market rumours, confidential information and leakage of private information. The Corporate Disclosure and Communication Policy also specifies the authorised spokesperson for OHB to ensure consistent and accurate representation of disclosures to stakeholders, in addition to ensuring disclosure practices are compliant with the Listing Requirements.

The Group Chief Financial Officer is designated as the primary contact person for inquiries from analysts and investors. In addition to the contact information of the Group Chief Financial Officer, OHB’s investor relations’ e-mail address ir@ohb.com.my is also provided on the website to increase accessibility of information for stakeholders, including potential investors.

Whilst OHB has yet to adopt Integrated Reporting, the Board is of the view that the existing Annual Report and Sustainability Report together provides a holistic view of the Group’s performance, including financial and non-financial information, the long-term sustainability of the Group’s businesses, and includes elements of an integrated report such as the organisation overview, outlook and external environment, governance policies, performance and the basis of preparation and presentation.

These developments signal a significant step forward and has positioned the Company on a solid footing to adopt Integrated Reporting. Moving forward, the Board would like to allow an advocacy period for the awareness of Integrated Reporting to be better appreciated by Management personnel before it is adopted.

II: Conduct of General Meetings

The AGM forms the principal avenue for a productive two-way dialogue between the Company and its stockholders.

The notice of 61st AGM was circulated at least 28 days prior to the date of the meeting, beyond the 21 days as required by the Companies Act 2016, to give stockholders sufficient notice and time to consider the resolutions to be discussed and decided. The notice for AGM outlines the resolutions to be tabled during the meeting and is accompanied with explanatory notes and background information where applicable. In addition, the notice of AGM also provides information beyond the minimum content stipulated in the Listing Requirements, such as the bases or justifications for recommending the re- appointment and/or re-election of directors, to enable stockholders to make informed decisions. The AGM was conducted through live streaming and online remote participation using Remote Participation and Voting (“RPV”) Facilities via an electronic meeting platform.

All Directors attended OHB’s 62nd AGM on 13 June 2024. The Group Chief Financial Officer presented an overview of the Group’s FY2023 performance and outlook for 2024 and shared the responses to questions submitted in advance by the Minority Shareholders Watch Group and other stockholders. The Executive Chairman, Executive Directors and Group Chief Financial Officer were responsible for answering the questions relating to business operations raised by stockholders. The Chairpersons of the Board Committees were also prepared to answer any questions addressed to them.

The Board Chairman, who also chaired the AGM, specifically expressed that every member present at the 62nd AGM either in person, by proxy, or by corporate representative, has the right to participate, ask question and vote on the resolutions. During the AGM, questions had been posed via real time submission in the software’s query box. The AGM has a dedicated session for questions and answers (“Q&A”) where similar questions were grouped together and answered accordingly.

All the resolutions set out in the Notice of the 62nd AGM were put to vote by poll and the voting was conducted through online remote voting. The outcome of the AGM was announced to Bursa Malaysia on the same day. The full AGM minutes, including questions posed by stockholders and the responses by OHB, and the outcome of resolutions, amongst others, were published on OHB’s website within 30 business days after the AGM.

This Statement was approved by the Board of Directors of OHB on 17 April 2025.